how much tax is taken out of my paycheck new jersey

The FUTA rate for 2022 is 6 but many employers only have to pay 06 each. Web New Jersey New Jersey Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the.

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Your employer uses the information that you provided on your.

. Web The new payroll tax law allows New Jersey municipalities to impose a payroll tax on businesses of up to 1 of wages. New Jersey income tax rate ranges from 140 to 1075 and there are also three types of payroll taxes. Web Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web How Your New Jersey Paycheck Works. Web While they are little things that not many people think about your business thrives on these tiny details and therefore you are able to have tax deductions on them. Web What taxes do New Jerseyite pay.

Web Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Web New Jersey announces new rate tables each year which can be found at the New Jersey Department of Labor and Workforce Development. Web The tax rate on wages over 1000000 and up to 5000000 for the State of New Jersey has changed from 213 percent to 118 percent for all tax tables.

Web If you make 55000 a year living in the region of New Jersey USA you will be taxed 10434. Web New Jersey State Payroll Taxes New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million. That means that your net pay will be 44566 per year or 3714 per month.

Web Its called FUTA and its an annual tax employers pay on the first 7000 of each employees wages. What is the NJ tax rate for 2020. Just enter the wages tax withholdings and other.

You still need to. Supports hourly salary income and multiple pay frequencies. Federal income taxes are also withheld from each of your paychecks.

Web Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this. The New Jersey taxable wage base.

Nj To End Temporary Work From Home Tax Rules Nj Spotlight News

A Complete Guide To New Jersey Payroll Taxes

Salary Paycheck Calculator Calculate Net Income Adp

Alabama Hourly Paycheck Calculator Gusto

Tax Withholding For Pensions And Social Security Sensible Money

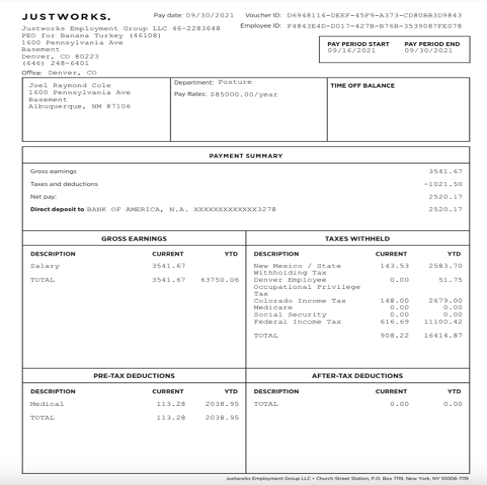

Questions About My Paycheck Justworks Help Center

Visualizing Taxes Deducted From Your Paycheck In Every State

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

New Jersey S Back To School Sales Tax Holiday Starts Experts Aren T Thrilled New Jersey Monitor

Prepare E File 2022 New Jersey Income Tax Returns Due In 2023

2020 S Hr Landscape For New Jersey Employers Abacus Payroll

New Jersey Income Tax Calculator Smartasset

A Complete Guide To New Jersey Payroll Taxes

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator New Jersey Nj Hourly Salary

Income Tax Florida How Much You Could Save Wtsp Com

If I Live In Nyc But Work Outside The City Do I Have To Pay City Income Tax Quora